From the Indiana House Republicans:

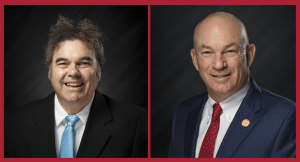

The Indiana Governor recently signed into law a $1 billion tax-relief package, the largest tax cut in the state’s history, that was co-authored by State Reps. Jeff Ellington (R-Bloomfield) and Bruce Borders (R-Jasonville).

According to Ellington, House Enrolled Act 1002 will drop the state’s individual income tax from 3.23% to 2.9% over seven years. He said once fully phased in, Indiana will have one of the lowest income tax rates in the nation.

“As revenue collections continued to surge, we jumped at the chance to provide tax relief,” Ellington said. “Hoosiers worked hard during the pandemic and they’re a huge part of why the state could weather the storm financially.”

The law also helps lower utility bills for Hoosiers and businesses by eliminating the 1.46% Utility Receipts Tax currently paid on electricity, natural gas, water, steam, sewage and telephone bills.

Borders said once both tax cuts are fully implemented, Hoosiers would save over $1 billion a year.

“I know how hard Hoosiers work to earn a living,” Borders said. “They deserve to keep more of their money and decide for themselves the best way to save and spend it. I joined my fellow Republicans in prioritizing these tax cuts, and will continue to advocate for a state government that lives within its means.”

The law also includes using reserves to make a one-time, $2.5 billion payment toward pre-’96 teacher pension obligations. This comes after Indiana has paid down well over $1 billion in debt over the last year alone.

House Enrolled Act 1002, a priority for Republican lawmakers, comes as the state’s budget reserves are expected to hit a record $5 billion at the end of fiscal year 2022. As revenues continue to outpace expectations, Hoosier taxpayers can expect a $125 refund this spring as part of a combined refund of over $545 million. A new law supported by Ellington and Borders will ensure the maximum number of Hoosiers qualify for the refund.

This legislative session, both Ellington and Borders authored legislation to reduce or eliminate Indiana’s income tax. Ellington’s House Bill 1027 would’ve lowered Hoosiers’ income tax rate from 3.23% to 3% beginning next year. Borders’ House Bill 1349 would’ve replaced individual and corporate income taxes with a higher sales tax or other adjustments to the tax base to replace the lost revenue. Both bills did not move forward in the legislative process.

Photos courtesy of the Indiana House Republicans